LAGOS – Trading on the Nigerian Exchange (NGX) for the week ending October 10, 2025, was heavily concentrated among a handful of leading stockbroking firms, with CardinalStone Securities Limited emerging as the clear dominant force by total transaction value.

Data from the exchange revealed that the top ten brokers were responsible for 63.36% of the total value traded across all asset classes, underscoring a significant market share held by key players.

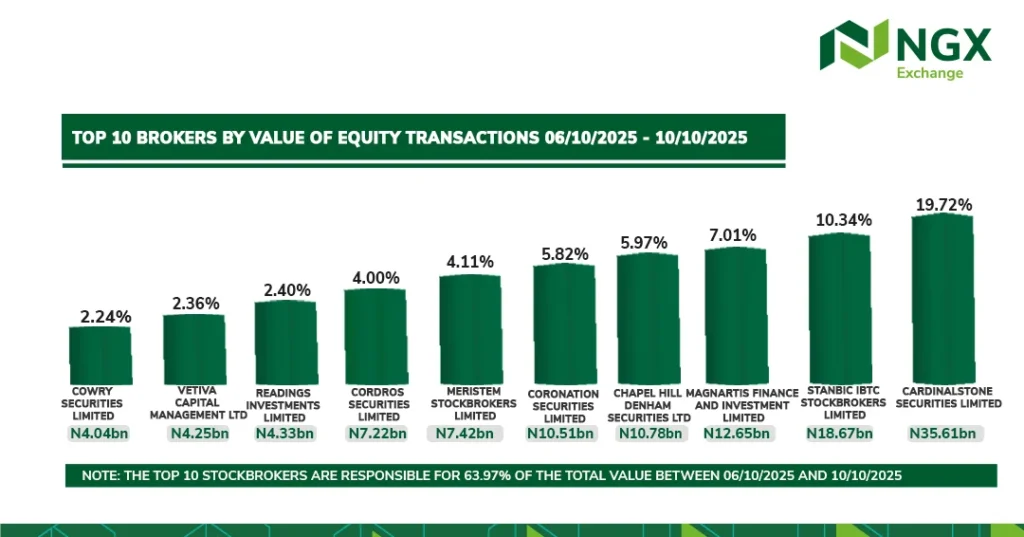

CardinalStone Securities Leads the Pack

A review of the “Top 10 Brokers by Value Across Asset Classes” shows CardinalStone Securities in a commanding lead, executing transactions worth N35.61 billion. This figure alone represented a substantial portion of the market’s activity for the week.

Stanbic IBTC Stockbrokers Limited followed in a distant second place with N18.67 billion, Magnarts Finance and Investment Limited placed third with N12.65 billion worth of transactions while Chapel Hill Denham and and Coronation Securities Limited posted N10.78 billion and N10.51 billion, respectively. The list of top firms by total value was rounded out by Meristem Stockbrokers Limited (N7.42bn), Cordros Securities Limited (N7.22bn), Readings Investments Limited (N4.33bn), VETIVA Capital Management Ltd (N4.25bn), and Cowry Securities Limited (N4.04bn).

Equity Market Leadership

In the equity-specific segment, the hierarchy saw a slight reshuffle, though CardinalStone maintained its top position. The firm led the “Top 10 Brokers by Value of Equity Transactions” with the same N35.61 billion, confirming that its dominance was primarily driven by stock trading.

Stanbic IBTC Stockbrokers (N18.67bn) and Magnarts Finance (N12.65bn) also maintained their strong second and third positions in the equity segment. Notably, the top ten equity brokers were responsible for 63.97% of all equity trading value during the period.

Bonds and ETFs Show Different Leaders

The story shifted dramatically in the bonds and ETFs markets, where different firms took the lead.

The bonds market was characterized by an extreme concentration of activity. A single firm, Arthur Steven Asset Management Ltd, dominated with a staggering 93.84% share of the top ten’s bond transaction value, handling N1.65 billion. The remaining nine firms, including SMADAC Securities Limited (N28.09m) and Apt Securities And Funds (N22.61m), accounted for just over 6% of the value among the top ten. Collectively, these ten brokers executed 99.81% of all bond trades.

The Exchange Traded Funds (ETFs) market presented a more distributed landscape. SMARAC Securities Limited was the top broker by value, with N6.82 million, representing a 14.18% share among the top ten. It was closely followed by YFTIYA Capital Management Ltd (12.41%), Meristem Stockbrokers Limited (11.81%), and Afrinvest Securities Ltd (11.49%). The top ten ETF brokers accounted for 86.83% of the total value in that asset class.

Analysis and Market Implication

The data highlights the pivotal role of a small group of institutional brokers in driving liquidity on the NGX. The overwhelming dominance of CardinalStone Securities in equities and the hyper-concentration in the bonds market with Arthur Steven Asset Management suggest that large, block-sized transactions from institutional clients or proprietary trading desks were a defining feature of the week’s activity.

Market analysts often view such concentration as a double-edged sword; while it indicates robust activity from major investors, it also points to a need for broader market participation to deepen liquidity and reduce volatility. The coming weeks will reveal if this trend of concentrated trading persists or if a more diversified broker activity emerges.

More Stories

EPIC FURY: U.S., Israel Strike Iran; Khamenei Reportedly Killed

EU Reaffirms Support for Credible, Inclusive Anambra Governorship Election

China Articulates a Global South Vision for Fairer Governance